Technical Analysis

Real-time stock market insights can be used for technical analysis to identify trading opportunities and make informed decisions. Technical analysis involves studying price charts and historical data to predict future price movements.

With real-time data, traders can identify trends, patterns, and support and resistance levels more accurately. This allows them to make timely decisions based on the latest market conditions.

Specific Technical Indicators

- Moving Averages:Calculate the average price of a stock over a specified period to smooth out price fluctuations and identify trends.

- Relative Strength Index (RSI):Measures the magnitude of recent price changes to identify overbought or oversold conditions.

- Bollinger Bands:Plot a set of upper and lower bands around the moving average to identify volatility and potential breakout levels.

Benefits of Technical Analysis with Real-Time Data

- Enhanced Accuracy:Real-time data provides the most up-to-date information, increasing the accuracy of technical indicators.

- Timely Trading Decisions:Traders can react quickly to market changes and make timely trading decisions.

- Improved Risk Management:Real-time insights help traders identify potential risks and adjust their strategies accordingly.

Challenges of Technical Analysis with Real-Time Data

- Data Overload:The constant stream of real-time data can be overwhelming and difficult to analyze.

- Noise and False Signals:Real-time data can be noisy and contain false signals, making it challenging to identify genuine trading opportunities.

- Reliance on Historical Data:Technical analysis relies on historical data, which may not always be reliable in predicting future price movements.

Fundamental Analysis: Real-Time Stock Market Insights

Fundamental analysis is a method of evaluating a stock by analyzing its financial data and other relevant information to determine its intrinsic value. Real-time stock market insights can be used to enhance fundamental analysis by providing up-to-date information on a company’s financial performance, news, and other factors that can affect its value.

Specific Fundamental Data

Specific fundamental data that can be used with real-time data include:

- Financial statements (income statement, balance sheet, cash flow statement)

- Earnings per share (EPS)

- Price-to-earnings (P/E) ratio

- Debt-to-equity ratio

- Return on equity (ROE)

Advantages and Disadvantages

The advantages of using fundamental analysis with real-time data include:

- More accurate valuation of stocks

- Identification of undervalued or overvalued stocks

- Improved timing of investment decisions

The disadvantages of using fundamental analysis with real-time data include:

- Can be time-consuming and complex

- Requires a deep understanding of financial data

- May not be suitable for all investors

Risk Management

Real-time stock market insights can play a crucial role in risk management by providing traders and investors with up-to-date information and data on market movements and fluctuations. This enables them to make informed decisions and adjust their trading strategies accordingly.

By monitoring real-time data, traders can identify potential risks and take steps to mitigate them. For example, if a stock’s price is experiencing a sharp decline, real-time insights can help traders determine whether it is due to a temporary market fluctuation or a more significant issue, such as negative news or a change in company fundamentals.

Specific Risk Management Strategies, Real-Time Stock Market Insights

- Stop-loss orders:Real-time insights can help traders set appropriate stop-loss orders to limit potential losses. By monitoring real-time price movements, traders can adjust their stop-loss levels accordingly to ensure they are not triggered by temporary market fluctuations.

- Position sizing:Real-time data can assist traders in determining the appropriate position size for their trades. By analyzing market conditions and volatility, traders can adjust their position size to manage risk and optimize returns.

- Risk-reward ratio:Real-time insights can help traders calculate the potential risk-reward ratio of a trade before entering a position. By comparing the potential profit with the potential loss, traders can make informed decisions about whether a trade is worth taking.

Risk management is paramount when using real-time data, as it helps traders and investors protect their capital and avoid significant losses. By leveraging real-time insights and implementing appropriate risk management strategies, traders can increase their chances of success in the dynamic and volatile stock market.

Trading Strategies

Real-time stock market insights can be leveraged to develop effective trading strategies. These insights provide traders with up-to-date information on market movements, enabling them to make informed decisions.

Traders can use real-time data to identify trends, spot opportunities, and manage risk. By analyzing the data, traders can gain insights into market sentiment, price movements, and volatility.

Specific Trading Strategies

- Trend Following:This strategy involves identifying and following the prevailing trend in the market. Traders use real-time data to identify trends and enter trades in the direction of the trend.

- Scalping:This is a short-term trading strategy that involves profiting from small price movements. Traders use real-time data to identify quick price fluctuations and execute multiple trades throughout the day.

- News Trading:This strategy involves trading on the news and events that can impact stock prices. Traders use real-time data to monitor news and announcements and react quickly to price movements.

- Pairs Trading:This strategy involves trading two related stocks that have historically moved in tandem. Traders use real-time data to identify discrepancies in the prices of the two stocks and profit from the spread.

Factors to Consider

When developing a trading strategy using real-time data, it is important to consider the following factors:

- Market Volatility:Real-time data can provide insights into market volatility. Traders should consider the volatility of the market when choosing a trading strategy.

- Time Frame:Traders should determine the time frame of their trading strategy based on their risk tolerance and trading style.

- Risk Management:Real-time data can help traders manage risk by providing insights into potential price movements. Traders should incorporate risk management techniques into their trading strategy.

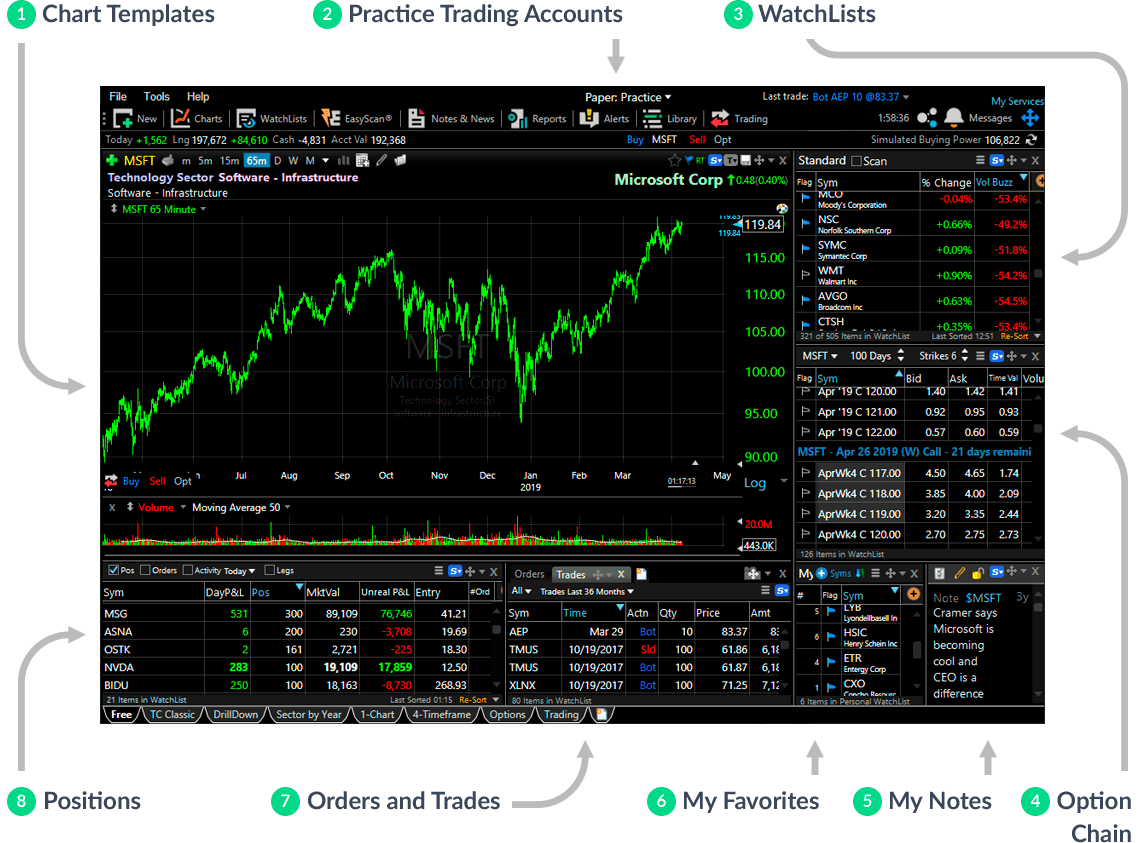

Data Visualization

Data visualization plays a pivotal role in real-time stock market insights by transforming complex data into visually comprehensible formats. It allows traders and analysts to quickly identify patterns, trends, and anomalies that might otherwise be overlooked.

Types of Data Visualization Techniques

Numerous data visualization techniques are available for real-time data analysis, including:

- Line Charts:Display data points connected by lines, showcasing trends and changes over time.

- Bar Charts:Compare values across different categories, enabling easy identification of highs and lows.

- Scatter Plots:Plot data points on a two-dimensional plane, revealing correlations and relationships.

- Heat Maps:Visualize data in a grid format, using colors to represent values, allowing for quick identification of patterns.

- Interactive Dashboards:Combine multiple visualizations and allow users to customize the display, enabling tailored insights.

Improving Decision-Making

Data visualization enhances decision-making by:

- Pattern Recognition:Identifying patterns and trends in real-time data facilitates timely trading decisions.

- Risk Assessment:Visualizing historical and current data helps assess potential risks and make informed decisions.

- Scenario Analysis:Visualizing different market scenarios allows traders to plan and prepare for potential outcomes.

- Performance Monitoring:Tracking performance through visualizations provides insights into trading strategies and areas for improvement.

- Communication:Visualizations effectively communicate complex insights to colleagues and clients, fostering collaboration and understanding.